Key Highlights from Budget 2018: Bold on vision, short on outlays

* Fiscal deficit is 3.5% of GDP at Rs 5.95 lakh crore in 2017-18. Projecting fiscal deficit to be 3.3% of GDP in the next fiscal

* Rs 21.57 lakh crores transferred as net GST to states against a projection of Rs 21.47 lakh crores

The discussion veers towards GST, particularly evasion and profiteering. Citing the case of HUL, Jaitley says that the FMCG major voluntarily came forward and deposited the extra revenue generated as it did not pass the benefit in GST cut to consumers. The restaurants, too, he says did not increase, prices after GST was cut to 5 percent. The government has also established an anti-profiteering authority as a deterrent, he says.

On reduction in Swachch Bharat fund, the FM says that it has been adopted by CSR of many corporates and the results show very clearly that it has been successful. He says that earlier, toilet coverage was 36 per cent but that has increased to more than 70 percent now. Many more districts have also become defecation free, he says.

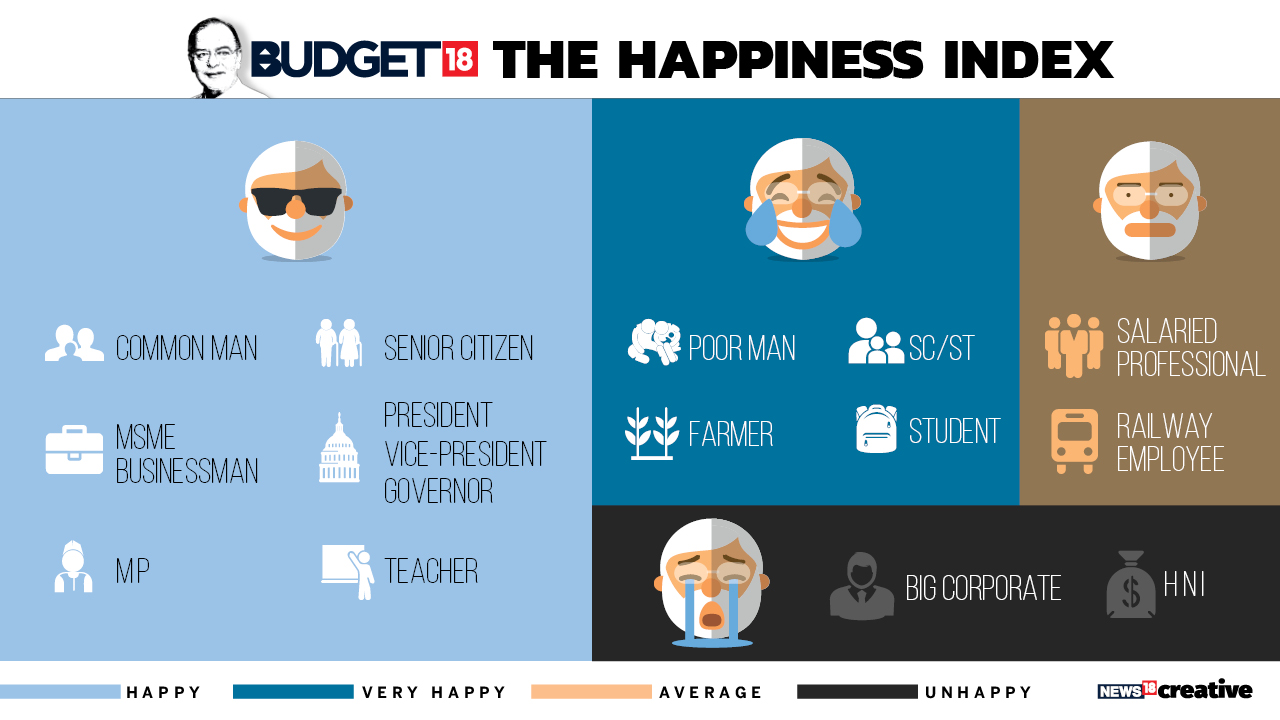

This budget has been classified anti-middle class, but Jaitley says any expenditure on healthcare, education and infrastructure benefits the middle class. Previously, too, the government had increased the exemption limit and those in the Rs 5-7 lakh income category can get away with very little tax.

Jaitley says that the impression that only a few pay tax needs to be corrected. There are around 25 crore families. Out of this, there are farmers who are tax exempt, then there are those of BPL category and there are those who are below the tax net. With expansion of TDS, last year 8.25 crore people filed returns. So the target of 10 crore taxpayers is not impossible anymore, says the FM.

The FM says improved infrastructure in Railways will take some time but results will come, but the infra push is already showing results in airports and roads. At the end, it will also benefit the middle class as it improves the economy and creates jobs.

The FM clarifies that MSP will not only be for the Kharif crop. It is a principle that is here to stay. Funds have already been sanctioned to procure crops like potatoes for cold storage, says Jaitley.

Jaitley, on fiscal math, says that it would largely depend on oil prices. If they stay in the current range, the revenue won’t be affected. But if they go through the roof, there could be some trouble.

On taxation of capital gains, Jaitley says the proposal was pending for several years. More than Rs 3 lakh crore was the tax exemption on capital gains in the last financial year, says Jaitley. Most of this was large investors. So, we took a conscious decision to generate revenue for social security schemes. This was a subsidy for the richest. Capital gains tax can alone foot the bill for the health protection scheme and MSP.

The FM says that the idea of National Health Protection Scheme is the largest social security scheme in the country. The idea was first mooted by Niti Aayog after it did a detailed universal healthcare system. He says that funds should not be a problem as there are more revenue generating schemes like capital gains tax and more cess. He hints that if the scheme is successful, it could become a universal healthcare scheme later. The scheme would first cater to 10 crore people on the bottom of the economic ladder.

The FM is asked about the high fuel prices and daily revision practice. The FM says a part of the tax is collected by Centre and a large part by the state government. When the prices went up, the Centre cut excise duty by 2 per cent. Some BJP states did too, but others, particularly, Kerala, refused point blank. The amount collected is very essential to build infrastructure. Rational citizens should understand that although the prices are troublesome, the taxes are to build roads that vehicle owners use too.

On the jump from 5 to 20 per cent tax, the FM says that the pattern is being studied. Last year too, there were concerns that those who fall in the higher category could try to evade but that has not happened due to government measures, says FM.

When asked why exemption limit was not increased, the FM says that you have to see what this government has done in totality. He says the government had earlier reduced tax for income up to Rs 5 lakh to 5 per cent, lowest anywhere in the world. There are other benefits like ATC and standard deductions. If one plans carefully, one can save a lot of tax, says FM.

The talkathon starts with a question on the benefit of standard deduction in lieu of travel of medical exemptions. Jaitley says that a standard practice will make it more uniform as earlier not everyone was able to take benefit of the exemptions. Everyone from a class d to a top employee will get benefit. The total benefit to the salaried class will be Rs 8,000 crore.

Do you have any questions about the Budget you would like to ask Finance Minister Arun Jaitley directly? The #AskYourFM talkathon begins shortly, in which he would take questions from the public. So be ready to start tweeting.

According to sources, Andhra Pradesh CM Chandrababu Naidu is very unhappy with the Budget and has asked party’s MPs in Delhi to escalate the issue. It was the last budget before the election in the state at the end of this year. Meanwhile, another TDP MP has come forward to express disappointment over the budgetary allocation for the state. “We from Andhra expected a lot. We’re disappointed. There is no benefit to Andhra Pradesh. Till now all issues in the govt are pending. They gave so much to Karnataka, Maharashtra. This is our coalition govt. What will we say to the people?” asked CM Ramesh.

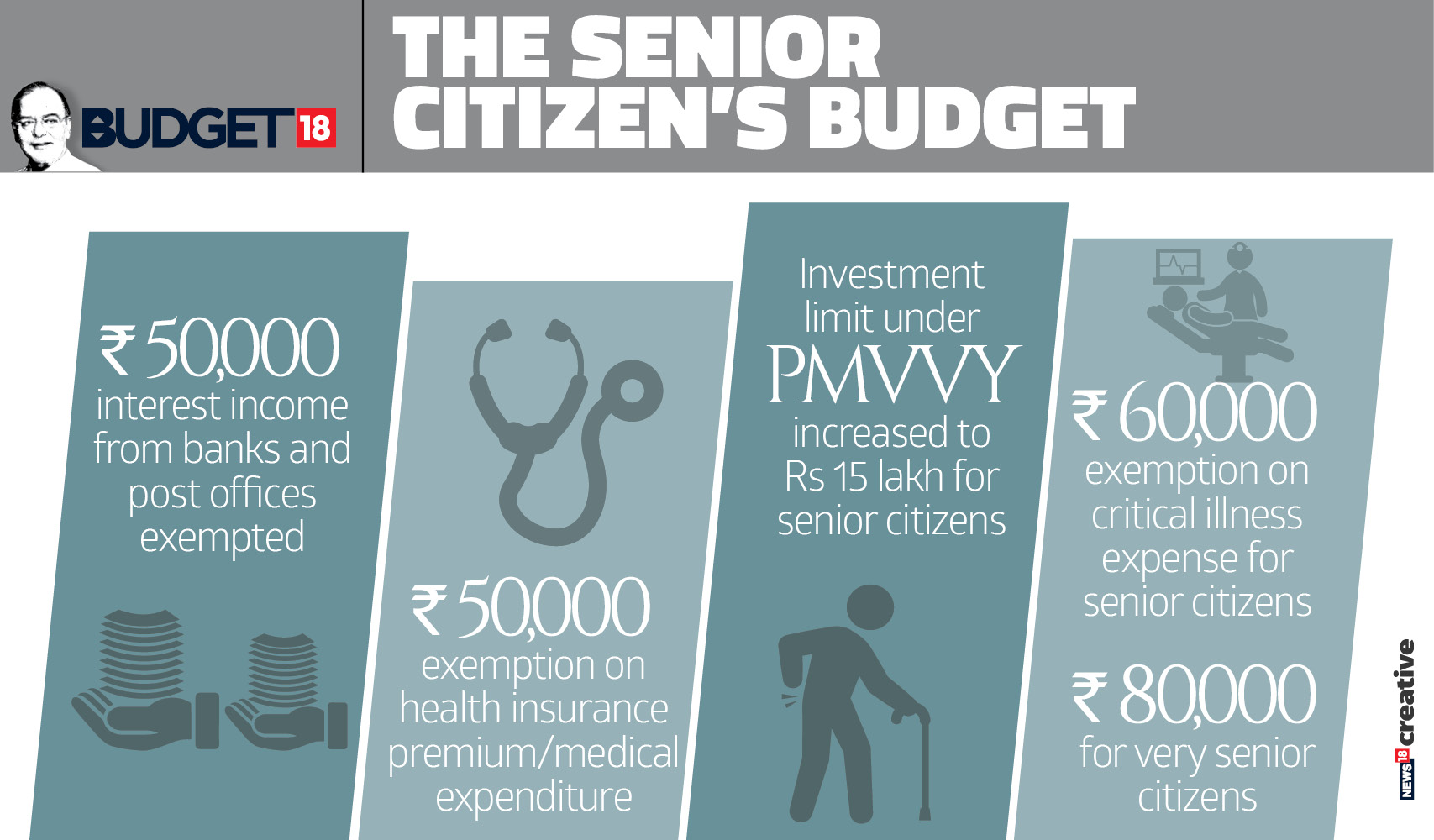

Here is what the Budget had in store for senior citizens:

The mobile phone industry has appreciated the budget proposal to hike customs duty on mobile phones saying it will increase the share of local manufacturing. Finance minister Arun Jaitley today announced a hike in customs duty on mobile phones to 20 per cent from 15 per cent in a bid to boost local value addition in domestic electronics manufacturing. Chinese firm OnePlus that operates in premium smartphone category said around 85 per cent of all smartphones sold in country are now produced locally and this is an opportune time to introduce next set of regulations to attract investment in manufacturing. According to research firm Gartner the high-end devices are, however, likely to be impacted. “More than 80 per cent of mobile phone demand is met locally but premium, high-end smartphones still depends on imports which will get hit by proposed increase in duty. Increase in duty will further strengthen proposals under consideration for local mobile phone production,” Gartner Research Director Anshul Gupta said.

Despite the Rs 40,000 standard deduction, there would be little relief to salaried class as benefits under the proposed deduction will be neutralised to a large extent by inclusion of transport and medical allowances and 1 per cent hike in health and education cess. Already the individual tax payer was getting benefit of Rs 19,200 under transport allowance and Rs 15,000 crore under the medical allowance. Both these components add to the tax benefit of Rs 34,200 crore per annum.

Salaried taxpayers and pensioners need not have to furnish any bills or documents to claim the standard deduction of Rs 40,000 announced in the budget, according to CBDT chief Sushil Chandra. “The budget, this time, has given a large benefit of flat Rs 40,000 as a standard deduction to the salaried class of taxpayers and pensioners. Earlier, some people were getting conveyance allowance and some medical allowance on the basis of production of bills but now we have removed all individual allowances on production of certain bills among others. It is flat Rs 40,000 to every salary earner. You can straightaway claim it,” Chandra says.

Sudharshan Venu, joint managing director of TVS Motor Company, has given a thumbs up to the Budget “The Union Budget 2018-19 demonstrates government’s intent to boost investments in rural development, education, healthcare and social sectors and will lead to continued and inclusive economic growth. The strong push for infrastructure will also support this growth agenda. The government’s focus on supporting local manufacturing, skill development under Pradhan Mantri Kaushal Kendra and a heightened emphasis on job creation will lead to greater opportunities for the youth of the country,” he says.

Mamata Banerjee: BJP government at Centre is not fit for governance. This is an anti-common man budget. They have done nothing to control the rising fuel prices, they have not done anything for job creation. This is a super-flop budget. There is no mechanism to meet the projection. There is nothing which can be appreciated, the expectations were high but the country did not get anything to cheer about.

Immediately after Finance Minister Arun Jaitley presented the Union Budget, minister for petroleum and natural gas, Dharmendra Pradhan said petro products will be a part of goods and services (GST) soon. “Once GST settles down, petro products to become part of GST. GST will be a logical platform for petroleum products. Petro products under GST will help rationalise prices,” said Pradhan.

BMS general secretary Virjesh Upadhyay said the Narendra Modi-led NDA II government has introduced this policy without consulting workers’ unions, without any talks or consultations at all and such a policy can only be passed through a tri-partite agreement between factory owners, unions and government.

TDP MP RM Naidu says the party is very disappointed with the budget. “One of the major issues was special status. Nothing was said by FM for Andhra Pradesh. If you take states like Telangana, Tamil Nadu they have huge budget but Andhra has deficit budget. People feel cheated,” he says. The ties between BJP and its coalition partner TDP have been strained for a while and the Budget seems to have widened the cracks. TDP’s parliamentary party leader and union minister of state for science and technology, YS Chowdhary, also said that many pressing state issues like Railway Zone, Polavaram project funding, funding for capital Amaravati and other pending issues of AP are not addressed in the budget.

The share market ended flat on Budget day as the wider-than-expected deficit target for the next fiscal year disappointed investors but spending in key areas of the slowing economy received a thumbs up. Here is a look at how the markets have reacted to the Budget announcement in the last few years:

Defence Minister Nirmala Sitharaman said that the first defence corridor will be built between Chennai and Bengaluru. The announcement for the second corridor will be made soon, she said. Finance Minister Arun Jaitley has proposed two defence industrial corridors to promote domestic production in both public and private sectors. Jaitley said the government will focus on the creation of these industrial corridors to boost investments in the production of defence armaments. When asked about the share of defence budget in GDP being the lowest since 1962 China War, she said that one needs to be ‘realistic’